Compliance Risks

Mistakes in local tax compliance, KYC/AML requirements, reporting, and international regulations can trigger audits, fines, restrictions, and penalties.

Managing payouts manually or through the wrong provider puts your business at risk, increases transaction costs, and damages your reputation.

Mistakes in local tax compliance, KYC/AML requirements, reporting, and international regulations can trigger audits, fines, restrictions, and penalties.

Non-compliant payments, inefficient cross-border transfers, unnecessary intermediaries, unfavorable exchange rates, and fines eat into your revenue and harm the viability of the business.

Late or inaccurate payments frustrate recipients, drain internal resources, increase costs, and damage relationships with employees, contractors, or customers.

Verifying user data, chasing missing info, handling disputes, and managing tax obligations distracts teams from their core responsibilities and reduces the organization's potential.

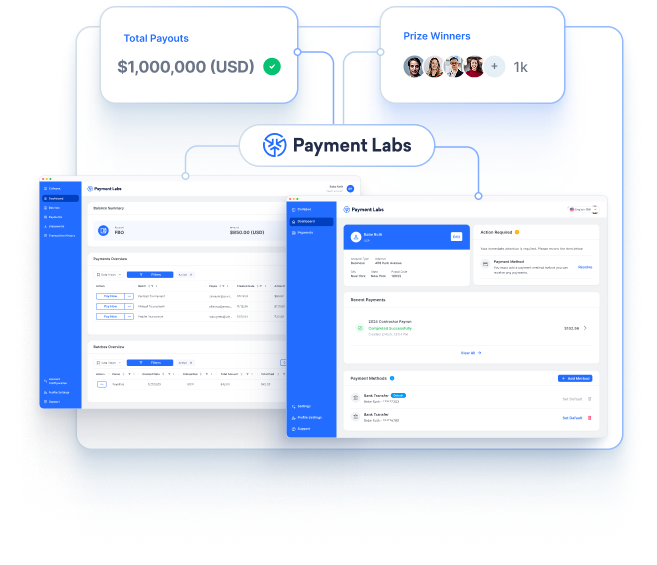

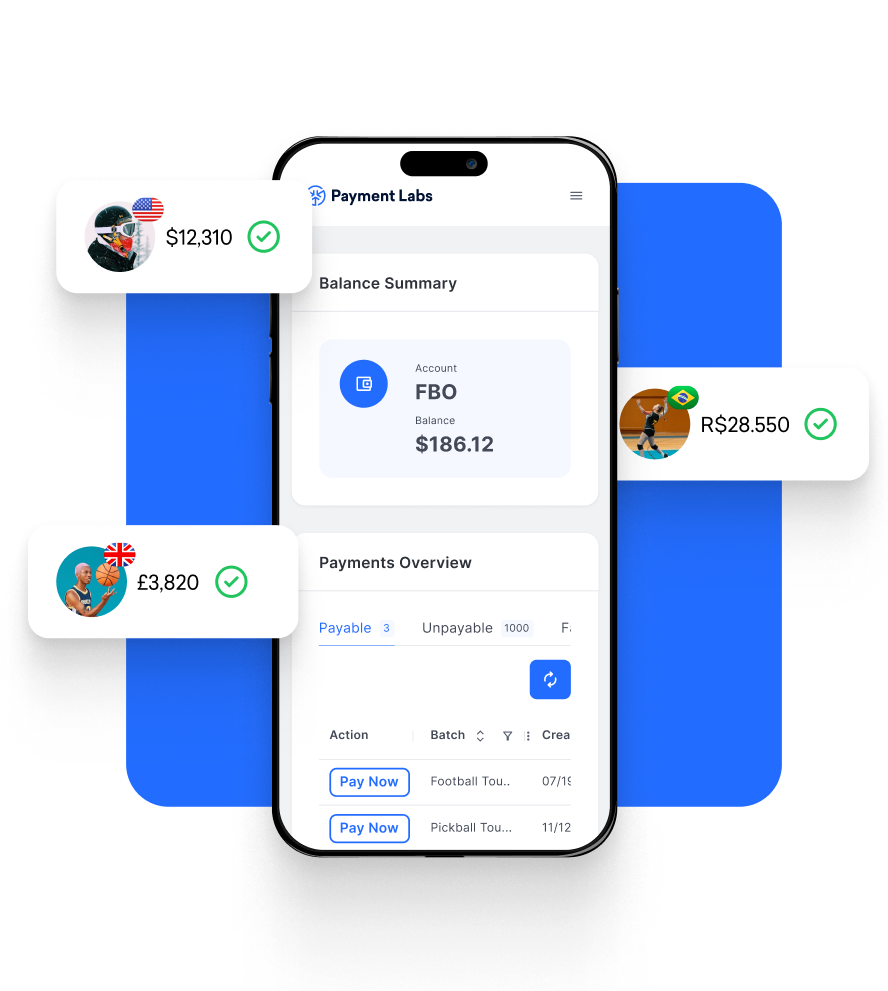

Payment Labs is built for organizations that need a reliable, flexible, and compliant way to manage domestic and cross-border payments:

Simplify payments, stay fully compliant, and minimize errors while keeping your team and users happy.

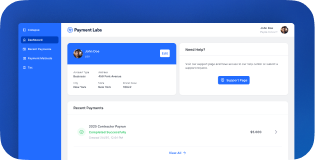

Working with Payment Labs helped us rest easy. Their platform's security, incomparable customer success team, and easy onboarding process ensured that we could focus on running an elite competition andnot fret over payments. Our athletes were able to get paid quickly and compliantly, no matter which country they are from.

Brad Florian

Director Global Business Operations

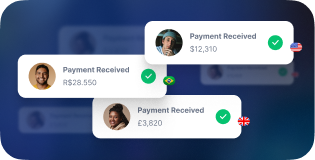

Deliver payments anywhere in the world cost-effectively with end-to-end encryption, live tracking, and full tax reporting readiness.

Built-in KYC and AML compliance, configurable tax withholding and remittance, and effortless cross-border scaling of payment operations.

Make single, scheduled, or batch payouts without manual workflows or spreadsheet-based transaction reconciliation.

Provide users with a choice to make and receive payments via ACH, wire, cards, or digital wallets from a single platform.

Scale operations without hidden fees or unexpected tier switches, and save costs on optimized cross-border transfers and currency conversion.

Connect Payment Labs to your existing systems for uninterrupted workflows or channel data from third-party tools.